Sydney: From dog massages to gourmet kitty treats, people spend billions each year to pamper their precious pets. But giving your favorite feline or canine a credit card could seriously be crossing the line.

Katherine Campbell's suburban Moggie (cat) is pretty much a bludger. He doesn't work and doesn't have an income. In fact he doesn't even leave the house. He gets everything from his owner, However, he sure did get a little visa power after Katherine decided that bank security was a little slack and wanted to test it out.

"You know, when you're trying to open up an account, they want your pay slips and they want this information, but to get an additional account you don't need any of that to be verified," says Katherine.

Katherine had a credit card with the Bank of Queensland and applied for a second visa in Messiah - her Kitty's name. And that's when she caught the bank having a catnap.

"They called me probably about a week later saying they needed a hundred points of ID for Messiah, and sent me back the application form with his credit card," says she.

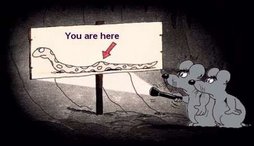

So now though Messiah doesn't have a driver's license, he doesn't own a passport and does not have a birth certificate, he has a credit card.

While the bank already had Katherine's details, to issue a second card - a card she's liable for all charges on - all they needed was the actual card number, and that could have been provided by anyone.

"You don't need to hack into the internet when you can just steal someone's credit card number and create a card for yourself," says Katherine.

In fact, had Messiah been a fraudster - and not a feline - Katherine wouldn't even have known the card existed.

"I wasn't notified that a second card had been issued. Messiah could have put a different address and the card would have been sent there and I wouldn't have known. If it's that easy for a cat to get credit, imagine what a dog could get," says she.

Humorous it maybe, but for Scott Brower, a financial expert who spends all day getting people out of credit card debt and teaching them how to be financially savvy, it's downright frightening.

"Well it totally shows a concern both from a fraud point of view and also for other people to access money, whether it's children, whether it's partners and other members of the family to be able to access money and the potentially spend money without the primary card holder knowing about it," says Brower.

The Bank of Queensland has apologised for the mistake and they're investigating how Messiah the Moggie even got a Visa in the first place.

His credit card has now been canceled - so too has Katherine's.

No comments:

Post a Comment